https://alcuinbramerton.blogspot.com/2020/10/altnews131ab.html

Alcuin Bramerton Twitter .. Alcuin Bramerton Medium

Alcuin Bramerton profile ..... Index of blog contents ..... Home .....#1ab

Picture: Is it time to change the Patron Saint of England? What about St Alban or St Edmund?

.%20Retire%20St%20George%20and%20replace%20him%20with%20St%20Alban%20(question).%20Or,%20perhaps,%20reinstate%20St%20Edmund%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: Switzerland? Ctrl-Alt-Delete?

.%20Ctrl-Alt-Delete%20(question).%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: "Unseen Portal" by Mark Heulsman (artist).

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Ancient stargates uncovered. How many of them are still live?

.%20And%20how%20many%20of%20them%20are%20still%20live%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: After Hiroshima, the ETs gave a warning to Humanity.

Picture: Money is broken. Is negative alien AI behind the capitalist subversions?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: A group of off-planet ET UFOs approaches an Egyptian pyramid in 2023.

Picture: Visiting pink cloudship?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Off-planet ET UFO flying low over Mosul (Iraq).

.%20%231ab.jpg?SSImageQuality=Full)

Picture: What is this UFO doing next to a military base?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Roswell, New Mexico (USA) - July 1947.

%20-%20July%201947.%20What%20did%20the%20unfortunate%20ET%20visitors%20have%20to%20say%20for%20themselves%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: What is this? A homemade UFO which came down in a European conifer forest?

.%20A%20homemade%20UFO%20which%20came%20down%20in%20a%20European%20conifer%20forest%20(question).%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: The pyramids of Antarctica as filmed in 1946.

Picture: Also Antarctica? Or somewhere else entirely?

.%20Or%20somewhere%20else%20entirely%20(question).%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Also Antarctica? Or somewhere else entirely?

.%20Or%20somewhere%20else%20entirely%20(question).%20%5BTWO%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Meditation for the US at the peak of the solar eclipse on 8th April 2024.

Picture: USA Eclipse Meditation - Monday 8th April 2024 - 6.18pm UTC.

Picture: Sisterhood of the Rose interview with Cobra about the April 2024 USA solar eclipse.

Picture: Deep changes imminent in Japan?

.%20March%202024.%20%231ab.jpg?SSImageQuality=Full)

Picture: Public health measures in Japan - March 2024.

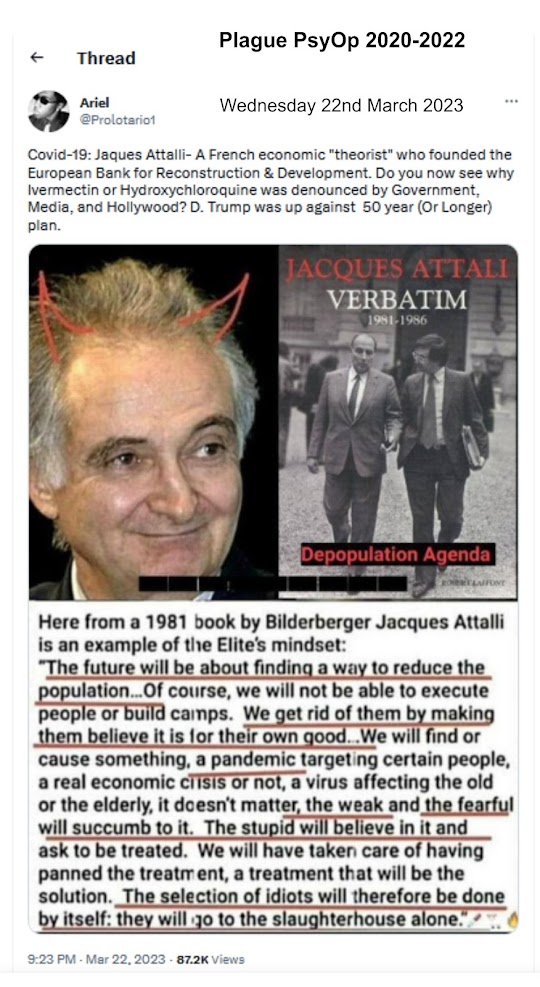

Picture: Update on the Plague PsyOp legal developments.

Picture: Putin characterises the record of the Western élites in international affairs.

%20characterises%20the%20record%20of%20the%20Western%20%C3%A9lites%20in%20international%20affairs.%20%231ab.jpg?SSImageQuality=Full)

..........................................................................................................

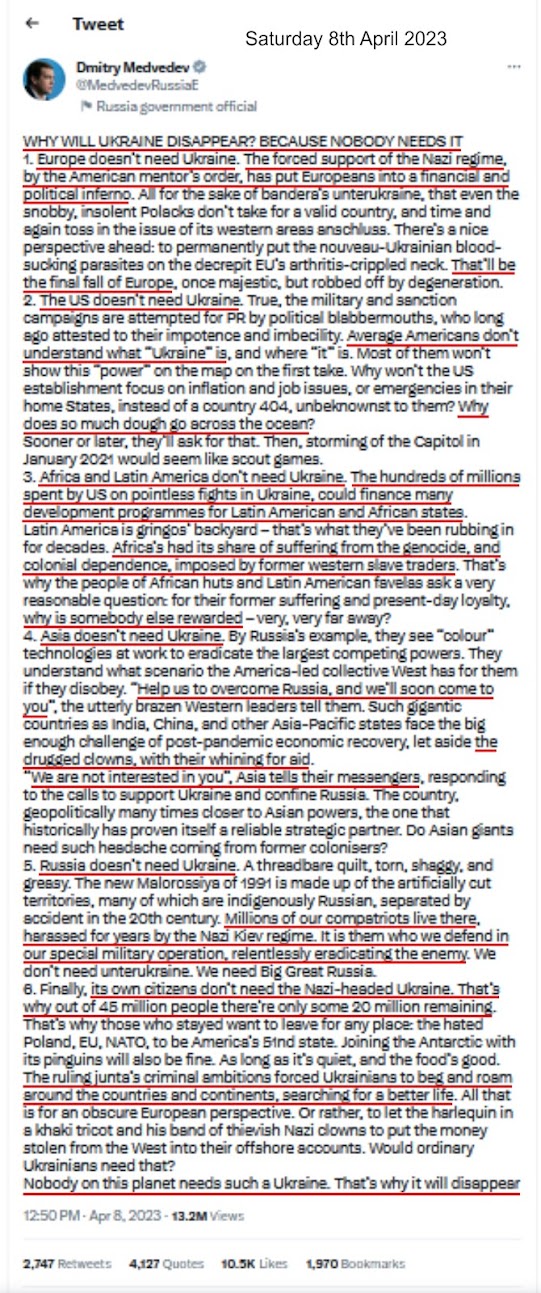

What Vladimir Putin says in the images above about the Western élites may not be intended metaphorically.

Consider the photograph below:

..........................................................................................................

Picture: 1546 statue on Kornhausplatz in Bern, capital of Switzerland.

%20%231ab.jpg?SSImageQuality=Full)

..........................................................................................................

This Hans Gieng statue is in a fountain on Kornhausplatz in the old town of Bern, the capital of Switzerland, and a UNESCO World Heritage Site. Standing in place proudly since 1546, it depicts an adult human in European dress eating naked children alive head first.

It is claimed that child trafficking, human cannibalism and the drinking of young human blood enriched with adrenochrome by conscious live torture, have always been private characteristics of the kind of Satanic Black Magic syndicates which in recent decades have taken over control of Western governance, banking, medicine and media.

But try finding anything objective about this in the corporate mass media which is not obviously an anti-'conspiracy' debunking piece. Only independent AltNews outlets run the story, for example in places such as this or this.

Apologists for the continuing prominent placement of the Bern statue are numerous and in Switzerland itself, apparently now emerging as the planet's dark heart of secret executive evil, not uncommon.

The cover stories are well-rehearsed. The statue is OK because it simply depicts the Greek god, Kronos (Cronus) who, according to one persistent myth-tradition, ate most of his children in order to prevent them from taking over his throne. Strange clothes for a Greek god, though.

Or the statue is OK because it is just a cartoon figure of the kind paraded at Swiss carnivals to intimidate misbehaving or unmanageable children into passive acquiescence. Passive acquiescence to who? And what kind of passive acquiescence?

Or the statue is OK because it represents the older brother of Duke Berchtold, the founder of Bern. This character is said to have gone into a rage and eaten many of the town’s children. But why celebrate him in a statue for doing that? Any why does Swiss history contain no credible record of this notable individual's actions?

Or the statue is OK because it simply warns of what happens when an undesirable minority group of some kind is allowed to gain power in the affairs of the capital. And there is absolutely nothing you can do about it. Really?

..........................................................................................................

Picture: Nazi-continuum geopolitical power-group surrenders.

Picture: Things fall apart; the centre cannot hold.

Picture: The Federal Reserve Note is a non-negotiable military scrip.

Picture: The Russian watch ticks.

%20%231ab.jpg?SSImageQuality=Full)

Picture: Are these the mummified remains of ETs found in Peru?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: The position of the Earth's equator during the time of Atlantis.

Picture: A city in New Atlantis or Old Atlantis, or both?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Cintamani stones came from the Sirius star system millions of years ago.

Picture: Aldebaran is the brightest star in the Taurus constellation.

Picture: Not as dark as all that, then?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Human activity on the Moon?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Operation Dreamland v1.4 operational. Thursday 22nd February 2024.

%20%231ab.jpg?SSImageQuality=Full)

Picture: Russian army clears out all remaining Kiev-supported combatants in Avdeyevka.

Picture: Planetary Situation Update and Phoenix Conference Report. 18th Feb 2024.

Picture: Reptilian physiognomies.

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Pavel Zarubin and Vladimir Putin in Moscow - 14th February 2024.

Picture: Tucker Carlson and Vladimir Putin in The Kremlin, Moscow - 9th February 2024.

%20on%20Friday%209th%20February%202024.%20%231ab.jpg?SSImageQuality=Full)

Picture: Valerii Zaluzhny (Ukraine) and Valery Gerasimov (Russia).

%20and%20Valery%20Gerasimov%20(Russia).%20February%202024.%20%231ab.jpg?SSImageQuality=Full)

Picture: Concerning the two widely-circulated documents on Monday 5th February 2024. [1]

Picture: Concerning the two widely-circulated documents on Monday 5th February 2024. [2]

..........................................................................................................

The two widely-distributed open-source information documents circulated globally on Monday 5th February 2024, and cited in the two images above, can be found here (pdf 30pp) and here (pdf 48pp).

..........................................................................................................

Picture: Agartha, The Hollow Earth, and the rise of the benevolent underworld civilisations.

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Agartha (The Hollow Earth) - Fact or Fiction?

%20-%20Fact%20or%20Fiction%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: Did they come from Agartha? The arrival of the Green Children in Woolpit.

.%20The%20arrival%20of%20the%20Green%20Children%20in%20Woolpit%20(Suffolk,%20England,%20UK).%20%231ab.jpg?SSImageQuality=Full)

..........................................................................................................

There may also still be an entrance from Agatha (Inner Earth; Hollow Earth; underworld) to the surface of the planet, in or around the village of Woolpit in Suffolk, England, UK (IP30 9QP).

A persistent local story of credible historicity has survived from the 12th Century CE.

Writers such as William of Newburgh (1136 -1198) and Ralph of Coggeshall (fl.1207-26) record a strange event which was witnessed by the Woolpit villagers, a landowner at nearby at Wilkes, and local people of senior official standing, sometime between 1135 and 1189. The event concerns the arrival of the Green Children in Woolpit.

A human brother and sister living in an underground civilisation called St Martin’s Land were one day tending their father's sheep in the countryside there. They encountered a cave which they hadn't seen before. They decided to go in and explore. They kept at this for a long time in the dark.

After a while they began to hear the sound of bells in the distance. They followed the sound. Eventually they saw a light up ahead, kept on walking towards it and emerged into bright sunlight. The intensity of the light shocked them. St Martin’s Land did not have light this bright. They had arrived in what we now call Suffolk, England, during the summer harvest time.

The children were found by reapers working in the fields near some ditches that had been excavated to trap wolves at St Mary’s of the Wolf Pits (now Woolpit).

The children had green-tinged skin (like the rest of their home population), their clothes were made from unfamiliar materials, and they spoke a language unknown to surface humanity.

Although they appeared to be starving, the two children would not eat any food they were offered until, eventually, the villagers brought them some recently harvested raw beans. These they devoured immediately.

The children then survived on a diet of raw beans only for many months until, at last, they acquired a taste for bread. Sometime after this they slowly lost their green skin colouration.

The boy became sick and died quite soon, but the girl lived a long life and married a royal official in King's Lynn, forty miles away in what we now call Norfolk.

The information about the childrens' origin came from the girl once she had had time to learn the 'English' spoken at that time in the east of England.

More background details about the Green Children of Woolpit can be found here and here.

..........................................................................................................

Picture: Exobiology. How long ago were these three engravings made?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Mummified alien fossil discovered in the Atacama Desert (Chile)?

%20(question).%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: What is this fellow doing wandering unaccompanied in a human facility of this kind?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: How long ago was this photograph taken, and why?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Where do the giants and their families and descendants live now?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Roman Churchianity and its senior management?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: The Age of Aquarius. In 2024, the benevolent energies build.

Picture: Meditation for Pluto entering Aquarius - Saturday 20th/Sunday 21st January 2024.

Picture: Galactic Central. The energies are rising.

..........................................................................................................

Human civilisations still operating long after their sell-by dates, never end tidily. So it is now with the West.

But the confusing, chaotic and illogical public nonsenses playing out at the beginning of 2024 - particularly those to do with self-injurious warmongering, crazy-person legislation and fake or long-dead political leaders wearing Hollywood-style plastico-rubber masks and spouting diversionary clown scripts - were not just due to human stupidity among the old disintegrating global élites.

New and turbulent cosmic energies are bathing the whole planet and these are tending to destabilise the thinking, speaking and behaviour of those large sections of the surface human population which have a lower than average spiritual light quotient or which simply cannot accept, or process coherently, all the fresh disclosures tumbling into the public domain.

This is the downside of enlightenment. If clear veridical enlightenment is rejected, or left unassimilated, the individual's conscious energies to do with clarity and focus become scrambled, mental health takes a nosedive and aberrant behaviours irrupt.

On the plus side, at the beginning of 2024 there was a lot of extraordinary technological activity going on invisibly higher up in the galactic architecture at levels above standard 3D conscious perception. Happily, almost all of this was benevolent and supportive of the now stable timeline unfolding a prosperous, healthy and free future for human civilisation on all continents.

In this connection, on another blog page, we have talked about Operation Dreamland and the new renaissance about to manifest across the planet.

Then, on Saturday 13th January 2024, another Higher Evolution-sourced intel drop from the same team revealed significant new information of uncommon current interest. That open-source article can be found here.

Decomposing negative syndicates in India and Africa, alarmed by the accelerating removal of the ancient dark energy potential known as subquantum anomaly, initiated a pulse of military mischief across the solar system in early January 2024. This led to short-lasting but violent battles on Planet X and around advanced ET bases on remote asteroids in and beyond the Kuiper belt.

In addition to all this, and at the same time, a powerful multidimensional group of long-standing benevolent influencers referred to as the Galactic Central Race activated all the old hidden Atlantean crystals on Earth. This included the thirty-foot-high Astar crystal located under seabed near Bermuda. An artist's impression of this crystal before it was submerged can be seen below. More background here.

Picture: Atlantean Astar crystal now buried under the seabed near Bermuda.

Those Atlantean crystals are now empowering positive energy grids around the world, helping the Earth towards its cleansing and planetary ascension.

To further increase the benevolent energy flows along Earth's meridians and ley lines, the Galactic Central Race has also just activated several dormant spaceships from the Atlantean period which currently lie buried beneath the Giza complex in Egypt, beneath the Amazon jungle and in Antarctica and elewhere.

Those spaceships are now connecting with Earth's planetary energy grid and linking it with the midway space stations which the Galactic Central Race constructed in ancient times. These midway space stations form a coordinated network which extends throughout the solar system.

The Galactic Central Race has also recently reactivated the Chaco Canyon site in New Mexico (USA). More background here. Original source article here (13.01.24).

..........................................................................................................

Picture: "What if ...?" asks Morpheus.

Picture: The resurrection of Project Blue Beam ??

.%20You're%20joking!%20%231ab.jpg?SSImageQuality=Full)

Picture: International public health - Saturday 6th January 2024.

Picture: Ascension Conference USA - Phoenix Arizona. 3rd - 4th February 2024.

Picture: Phoenix Ascension Conference notes from 3rd & 4th Feb 2024.

%20-%203rd%20&%204th%20Feb%202024.%20Compiled%20notes%20for%20both%20days.%20%231ab.jpg?SSImageQuality=Full)

Picture: Concerning the English royal bloodline.

..........................................................................................................

During the latter months of 2023, international legal, financial and geopolitical disquiet accumulated concerning the apparent historical instabilty of the UK/British deep state.

It became evident from ancient documentation and from more recent repeated legal rulings that a rogue Raj faction of Corporatists ostensibly scheming from within the London Crown Temple and the Inner City of London, and other associated negative syndicates, had radically subverted the Constitutional Monarchy of the nation since 1936.

For example, on Tuesday 19th December 2023, Anna Von Reitz (Anna Maria Riezinger, Fiduciary, The United States of America) distributed the following open-source notification to her international legal and financial readership:

This morning I wish to draw everyone's attention to the situation in Britain - which is falling apart by the hour.

We long ago observed that it is factually impossible for a King of England to exist. This is because William the Conqueror divided up the spoils from the Norman Conquest among his loyal Barons, and disinherited his own sons from owning any land in England.

Thus, ever since, the land and soil of England has been ruled by the progeny of French aristocrats, each one of whom enjoys "sovereignty in their own right" on the land and soil bequeathed to them by William of Normandy as of 1087 A.D.

This is called the Settlement of the Norman Conquest.

The Norman French Barons settled in as the new "kings" of England, took on the local color, and within a couple generations started looking and sounding like Englishmen - except for their French names, like Neville, Tousignant, Belcher, Plantagenet, Dumont, ....and....Talbot.

The Talbots were loyal retainers in Normandy and remained so throughout all of William's adventures and all that his sons and grandsons weathered. The Talbots slogged through the Crusades with Richard the Lionheart, stood guard and took arms at Crecy, and manned the ramparts at Agincourt.

The Talbots served so well, so valiantly, and so loyally, that they were promoted to the position of Ultimate Trust: they became the Lord High Stewards of England, a position that they own to this day, even though the present Lord High Steward and Heir to his ancestral lands in Shrewsbury, happens to be living in Australia.

Understand that each one of these men are - within the context of their ancestral holdings - kings of England. They elected among themselves a "king of kings" in each generation, but that was more of an administrative accommodation --as demonstrated by The Magna Carta.

If they didn't like what "the" King was doing, they retained the right, as a group, to kick his arse. They still retain that right, down through all the generations of the Kings and Queens of England -- a fact that the office holders have always chafed against and sought to evade.

Now, with this background firmly in place in your minds, you can see why the creation of a new Office for the "king of kings" to occupy was highly desired in some quarters, and you will note that this was accomplished in 1707, when the combined Kingdom of England and Scotland, came into existence.

Though the office holder could still function as the King of England and be somewhat subject to the other "kings of England" in that office, he could now also function as the King of England, Ireland, Scotland, and Wales and obtain considerable weasel room by doing so. A separate degree of power was obtained by the office holder, simply by changing the jurisdiction of his office.

The office, "King of England" is a national office tied to the soil of England; the office "King of England, Ireland, Scotland and Wales" is an international office tied to the land and sea jurisdictions of these nations, and finally, "King of the United Kingdom" is a global, imperial office operated in the jurisdiction of the air.

Though we constantly hear the national and international offices referenced, the office holder isn't occupying these offices.

Elizabeth II, for example, abdicated her vows under the Christian Crown of England within three days of her Coronation - a fact established in the British High Courts under litigation - and instead spent her time operating as the Queen of the United Kingdom.

Her son, Charles III, didn't even bother to take the Christian Coronation vows and was directly crowned under the Imperial United Kingdom office.

Try to keep this background information perking away as we move the "American Raj Conversation" to Britain, because as I have long said, the British people have suffered as long as the rest of us. The same rogue Raj elements of their own government have been used to pillage and subourne them, too.

When we examine things more closely, we see that the same exact process of impersonation and alienation of assets was used in Britain, and it developed in tandem with the English King becoming first the "King of England, Ireland, Scotland and Wales", and then still later assuming the foreign Imperial Office as the "King of the United Kingdom".

As the office holder acting as "king of kings" successively moved their office from the soil (England) to the land and sea (England, Ireland, Scotland and Wales) and to the air (United Kingdom) his empowerment changed and so did the character of government, the form of law, and the social contract.

With each change in the jurisdiction being occupied, the former jurisdiction was vacated.

Thus, when the King changed offices and stopped acting as the Christian King of England, the soil jurisdiction was vacated.

When he stopped operating as the King of England, Ireland, Scotland and Wales, the international jurisdiction of the land and sea was vacated.

The present Lord High Steward, Ivan Talbot, was aware that the land and soil of England were being vacated and that the associated High Offices were also left dangerously unoccupied -- whereupon he exercised his right and duty and reclaimed the land and soil that the late Queen abandoned and which the present King never entered upon.

Please note that it is his right to do this, as Hereditary Lord High Steward, and that it is also his duty; if he did not do it, he would be guilty of treason against the lawful government of England as well as the Territorial Government of England, Ireland, Scotland, and Wales.

This is similar to the situation we encountered in America, where the land and soil jurisdictions had been vacated without any public disclosure -- a circumstance that forced the Hereditary Head of State to reclaim the land and soil for the people of this country, too.

Technically, Queen Elizabeth II was "absent" from the English throne for 70 years and never properly occupied it; her Son has similarly remained absent from the soil of England and the land of England, Ireland, Scotland, and Wales. They have only appeared to be present, much as our government appeared to be present -- and wasn't.

The motivation for this ruse appears to have been a combination of greed, power-mongering, and evasion of accountability.

While the office holder gained wealth, arbitrary power, and bore no liability, the people lost their rights and property and the "other" kings of England were undermined and unable to exert their powers of restraint against a Monarch who had slipped the leash of shared sovereignty on the land and soil.

As a result of all this undisclosed finagling, Constitutional Monarchy disappeared during the reign of the late Queen's Father, and all that remained of it was a shell built of the people's trust and belief that it existed.

Like us, the people of England, and within the realm of Territorial powers, the people of England, Ireland, Scotland, and Wales, were duped, preyed upon, and deprived of their rights and property by the Windsors and their Parliamentary Administrations.

Of course, some members of the Parliament had to know what was going on, especially members of the Privy Council, but apparently, their devotion to the office holder blinded them to their duty to the office and to the actual government and the social contract holding it all together.

Luckily for the people of England, and the People of England, Ireland, Scotland, and Wales, the Talbots were no shirkers or fools, and did their duty even when nobody else did. As a result, their Lord High Steward, Ivan Talbot, entered the appropriate claims and charges in a timely fashion and cured them nearly thirty years ago.

Talbot's claims, like our claims for The United States, prevent any wholesale disposition of the land and soil of the British homeland and Territorial holdings as abandoned property, and pave the way for recoupment and action against the corporations which have aimed at establishing a form of Corporate Feudalism and despotism in place of the Constitutional Monarchy that the people are owed.

Against all odds, by the grace of God, our nations have been pulled back from the edge of a dystopian nightmare - by the actions of two faithful but relatively unknown servants and guardians of their social contracts.

As you are enjoying this Christmas season and looking forward to the clean, bright New Year ahead, take a moment to bless the accretion of traditions, customs, and safeguards built into our venerable governments, and thank God that those little-known safeguards have held steady in the face of one of the most duplicitous, evil, and secretive plots at the very highest levels of our governments - that our governments have ever faced.

If the Corporatists had been successful, our entire world would have been plunged into a maze of lies, wars, and confusions designed to enhance the powers of faceless, nameless, and unaccountable corporations, bent on promoting their own profit above any social benefit or good.

People would have been enslaved and cultures uprooted, religions would have been disgraced, and wisdom which has guided mankind for centuries would have been lost. The entire ethos of compassion would have been crushed under the wheels of commerce.

You have been saved from all of that. Give thanks.

Let the miracles of this season renew your minds and hearts.

And please, if you are from Great Britain, take a little time to visit Ivan Talbot's new YouTube channel; the videos posted will give you a recap and insight into his actions, his authority for those actions, and where things stand right now for the people of England and Great Britain.

Do not be dismayed - what is true will win over what is false, and what is good will triumph over evil.

Original text sources here (19.12.23) or here (19.12.23).

..........................................................................................................

Picture: Hitler, the Nazis and Argentina.

..............................................................................................................................

Larger image here.

..............................................................................................................................

Picture: Geowars. US, Ukraine, Syria and Libya. Sunday 17th December 2023.

Picture: Chiang Mai Ascension Conference - Day 1 notes.

............................................................................................................................................

The Ascension Conference in Chiang Mai (Thailand) was a huge success and was accompanied by a lot of underground and extraterrestrial activity.

The second day of the conference brought a very important breakthrough regarding the anchoring of the Goddess energy on the surface of the planet. This is expected to have far-reaching consequences well beyond Asia.

The Chiang Mai Ascension Conference Day 1 notes are here. And the Chiang Mai Ascension Conference Day 2 notes are here.

............................................................................................................................................

Picture: 4th December 2023 - major geopolitical changes expected.

Picture: Quan Yin plus dragons.

Picture: Taiwan. Tuesday 2nd August 2022.

%20%231ab.jpg?SSImageQuality=Full)

Picture: A Pleiadian UFO flies over Taiwan. August 2022. #1ab

Picture: Taipei (Taiwan). Red Dragon Rising.

.%20Red%20Dragon%20Rising.%20%231ab.jpg?SSImageQuality=Full)

Picture: Portal of Light Activation and Taiwan Conference Reports - May 2023.

Picture: Why do we have wars, Mummy?

.%20(One)%20%231ab.jpg?SSImageQuality=Full)

Picture: US population news. Friday 1st December 2023.

Picture: Galactic reunion imminent?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Saturday 25th November 2023. Operation Dreamland. Amor Vincit Omnia!

............................................................................................................................................

Operation Dreamland is a detailed action plan of the benevolent ET and human Light forces to start a new Renaissance on the surface of this planet. The first Renaissance 500 years ago was initiated by a positive occult group behind the White Nobility in 15th century Florence (Italy).

The second Renaissance to start in 2023-2025 will be initiated by the same occult group worldwide and will herald the final victory of the free human spirit over the forces of limitation.

Contact has been made with White Nobility lineages that were involved with the birth of the first Renaissance and may help with the creation of the second.

Contact made with Grail White Nobility lineages means restoration of the Magdalene mysteries as preparation for the true revelation of the Goddess.

The purpose of Operation Dreamland is twofold. First, to restore abundance to the Lightworkers. Many Ligthworkers currently have a belief system that spirituality means living in poverty. That belief system was mind programming from the now fast-diminishing negative syndicates. In truth, physical abundance is a natural expression of the beauty of the incarnated Soul and every Lightworker deserves it.

The Saint Germain Trust was established in the late 18th century by the Comte de Saint Germain. One of this trust's purposes was to assist the Lightworkers at the time of the shift of the ages. That shift began behind the scenes in 2023. The Saint Germain Trust will be unblocked as soon as all remnants of the negative syndicates are completely and visibly removed. Lightworkers will then finally be able to live in abundance.

The second purpose of Operation Dreamland is to start disseminating the true occult teachings of the mystery schools of the Ascended Masters.

In the last 26,000 years as this planet has been quarantined and almost completely cut off from direct contact with the Ascended Masters, spiritual teachings have degenerated and now the blind are leading the blind. One such example are many channeled messages that supposedly come from the Ascended Masters or the Galactic Confederation. What happens in most of those cases is a genuine energetic contact, but on the mental plane the (negative) Archons come in with their technology and insert messages that look full of love and light on a first impression, but in reality are just recycled phrases.

Two covert but very benevolent power groupings are worth mentioning in connection with Operation Dreamland: The White Nobility and the Brotherhood of the Star. Both have been quietly working towards the liberation of the planet since ancient times.

(1) White Nobility

During human history, not all aristocratic families have associated themselves with the negative syndicates. By 'negative syndicates' here, we use a portmanteau term intended to include all Satanic cadres and influencers and their minions sometimes, these days, referred to as the Khazarian Mafia, the Nazi-continuum or the Cabal. These negative conspirators have been, and still are the darkside foci of active service-to-self evil on the planet, involving various physical and non-physical human and ET entities.

Many aristocratic families have resisted the negative syndicates passively, some even actively. Noblesse oblige was not an empty phrase for them but an actual imperative to help the less fortunate members of humanity. Perhaps the most famous among White Nobility families were the Medicis who helped to bring about the Renaissance which laid the foundation of our modern world.

Common ground for all the noble families, past and present, is the occult tradition that goes back millennia into the mystery schools of ancient Rome, Greece and Egypt. The Mysteries of the Goddess are their greatest secret and their main occult weapon against the negative syndicates. Many of the White Nobility families have a strong connection with Mary Magdalene and the Grail mysteries, and are connected with positive Templar groups.

The Black Nobility families who are associated with the Jesuits are allergic to the Goddess energy. They would like to wipe it out from the surface of the planet and have tried to do so many times. Members of these negative families, until the middle of 2023, were receiving their orders directly from the Archons and were at the core of the conspiracy against the Goddess. They are still waging an occult war against the White Nobility families who are trying to spread the Light and support feminine qualities such as compassion, receptivity, creativity and love. Amor Vincit Omnia.

Most of the White Nobility families are now located in Italy and serve as a counterforce against the Black Nobility. They have lost most of their wealth in the last two centuries, but their positive occult tradition is still very much alive. Their names have not yet been disclosed to the general public. These lineages are not directly associated with the Savoy family, as some have suggested.They work tirelessly in the background for the benefit of humanity.

Some among the White Nobility families are involved with the creation of the new and fair financial system which will replace the current one very soon; another group is focused on revealing the occult knowledge of the ages.

(2) Brotherhood of the Star

The Brotherhood of the Star is a planetary oupost on Earth of the Blue Lodge of Sirius that is connected with Sirius via Jupiter and the Jupiter Command.

The purpose of the Brotherhood of the Star is to guide the evolution of Planet Earth under the guidance of Sanat Kumara, who is also known as The Ancient of Days or The Lord of the Earth. The inner circle of the Brotherhood of the Star are Masters and Arhats that have reached their Ascension on this planet.

The outer circle of the Brotherhood of the Star is the Esoteric Brotherhood comprised of disciples of the Ascended Masters that have reached the seventh subdegree of the third Initiation. The physical anchor of the Brotherhood of the Star is the vast subterranean kingdom of Shamballa, where the Great mystery school of the Transhimalayan Brotherhood is operating. The Esoteric Brotherhood represents its antechamber.

The Brotherhood of the Star has been working covertly since the time of Atlantis, 20,000 years ago. It has never had a recognisable public presence among the surface human population.

Disciples of the Brotherhood of the Star comprise the Order of the Star which is a community, a mandala of 144,000 star beings of the first, second and third Initiation who have incarnated on Earth with the purpose of maintaining an occult triangulation of light and darkness. Members of the Order of the Star have been influencing the world situation based on telepathic guidance from the Brotherhood of the Star.

They caused the flowering of Graeco-Roman culture aided by telepathic impressions from Brotherhood of the Star. They were active as Druid priests in Celtic culture. As Essenes they collaborated in the project of the Ascension of Jesus and the Magdalene/Grail family lineage as a counterbalance against the thirteenth bloodline of the black nobility.

They founded Sufi initiation orders. In the 12th century they founded the Cathar and Albigensian movement which revived the Goddess mysteries through Troubadour poetry, and they also revived the Gnostic Christianity mysteries from the times before the negative Constantinian Christian cult.

In the 13th century the Brotherhood of the Star and the Order of the Star founded the Templar order which was based on the discovery of Isisian esoteric texts in the crypt below the Solomon temple. Information on those scrolls enabled the revival of the old Egyptian star mysteries and the formation of freemasonry.

Based on an impulse from the Brotherhood of the Star, hidden Cathar lodges triggered the Renaissance in Florence around 1450, and this shaped our western civilization as we now know it. That western Renaissance civilisation fulfilled the conditions for the arrival of the first representatives of the Esoteric Brotherhood into Europe from subterranean Tibet.

Since the fifteenth century, several dozen representatives of the Esoteric Brotherhood have been working secretly behind the scenes in Europe. In the 16th century they were active mainly in Florence, Venice and Verona; in the 17th century mainly in London and elsewhere in England; and in the 18th century mainly in Paris.

The Esoteric Brotherhood transmitted the spiritual impulse for the beginning of the Enlightenment movement to the Order of the Star. This reshaped the 18th century and set the basis for the scientific and technological revolution.

The Esoteric Brotherhood also triggered the creation of the mystery school through Comte de Saint Germain in Paris in 1775. This secret mystery school was active for about 100 years, and then the Esoteric Brotherhood triggered the creation of the Theosophical Society through H. P. Blavatsky in 1875. Through telepathic impressions, the Esoteric Brothehood guided the progress of science, especially through Nikola Tesla.

At this present time the Esoteric Brotherhood is not involved in the matrix system on planet Earth. Their members live in undisclosed locations on the surface of the planet.

The esoteric symbol of the Brotherhood of the Star is the heavenly stone of Sirius: fire jewel, cinta mani, lapis ex coelis, which represents the jewel of our true Self (atma-buddhi-manas).

The esoteric symbol of the Order of the Star is a chalice of Moldavite, the heavenly stone of the Pleiades. This is the Holy Grail, the sangreal, which represents our causal body and the star nobility, the mandala of 144,000 star beings of light.

The Brotherhood of the Star is the last pure remnant of the mystery schools of Light from Atlantis. The negative syndicates tried to infiltrate it without success as it has very strict rules of admission.

Unfortunately, the negative syndicates were much more successful in infiltrating the more public mystery schools such as the (negative) Jesuits were able to do with freemasonry in the early 1800s. Later, the Theosophical Society was also infiltrated after Helena Blavatsky died in London in 1891. Her teachings were then misused by the negative syndicates. This misuse was the cause of much confusion among the Lightworkers. The true Blavatsky teachings will soon be restored as part of Operation Dreamland.

Fuller background information on these topics, including key family and lineage names, can be found in open source online articles such as these here, here and here.

...........................................................................................................................

Picture: Defective product recall - get ready.

Picture: US media - Case 4:23-cv-01175-P Document 1 Filed 11/20/23.

Picture: Dutch Central Bank has prepared for a new gold standard.

Picture: Asian sketch.

Picture: The standard of living of European Union citizens.

Picture: Are things beginning to stir behind the green door?

.%20November%202023.%20%231ab.jpg?SSImageQuality=Full)

Picture: Are Israel and the United States collapsing?

.%20Tuesday%2014th%20November%202023.%20%231ab.jpg?SSImageQuality=Full)

Picture: What is delaying the RV? Bank treaties?

.%20Bank%20treaties%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: Has the US now lost its First-World status?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: The US and Ukraine - Friday 10th November 2023.

Picture: International public health - November 2023.

Picture: Russia, Turkey, NATO and Ukraine. October 2023.

...............................................................................................................................

During her appearance at a meeting hosted by the Center for Strategic and International Studies (CSIS), NATO nuclear policy director Jessica Cox revealed that the Alliance did not agree to Ukraine’s membership.

Volodymir Zelensky spoke of a “humiliation”. Previously a UK rogue-faction operator had assured him that his country’s accession would be a mere formality. That UK operator has since been comprehensively and visibly removed from public office. And the now non-existent country once known as Ukraine is no longer credible as a legally-defined sovereign nation with legitimate or stable borders.

Russia, which had announced that it would interpret Ukraine’s accession as a declaration of war, did not comment on NATO's decision.

Online source here (29.10.23).

.............................................................................................................................

Picture: All change in China - Autumn 2023?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Cosmic anomaly [ONE].

Picture: Cosmic anomaly [TWO].

Picture: Cosmic anomaly [THREE].

Picture: Are Western-sourced weapons being used against Israeli forces in Gaza?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Mind control - human reality in the matrix?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

Picture: Does Mind Control Exist?

.%20The%20evidence%20accumulates.%20%231ab.jpg?SSImageQuality=Full)

Picture: The old agreement between the Czar of Russia and Frederick the Great.

Picture: Victory of the Light - October 2023

Picture: Iain Davis on Conspiracy Theory. October 2023.

Picture: Reiner Fuellmich taken from German embassy in Mexico.

...............................................................................................................................

Vladimir Putin: It is extremely important for us that Ukraine stays outside any blocs.

On Monday 16th October 2023, just before he left for meetings and top-level geopolitical talks in China, the Russian president, Vladimir Putin, gave an interview to Wang Guan of the China Media Group. The interview took place in The Kremlin, Moscow. One of the topics covered was Ukraine and NATO.

Vladimir Putin: The security of one group of states cannot be built at the expense of the security of other states. Security needs to be the same for everyone.

In this context, it is extremely important for us that Ukraine stays outside any blocs.

We were told as far back as 1991 - by the then US Administration - that NATO would not expand further east. Since then, there have been five waves of NATO expansion, and every time we expressed our concerns. Every time we were told: yes, we promised you not to expand NATO eastwards, but those were verbal promises - is there any paper with our signature on it? No paper? Good-bye.

You see, it is very difficult to engage in a dialogue with people like that.

Fuller coverage here: (16.10.23).

............................................................................................................................

Picture: Poland and Ukraine are at Loggerheads.

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Ukraine, Zelensky and Stepan Bandera.

.%20%231ab.jpg?SSImageQuality=Full)

Picture: True or False? How to fake a war-victim picture for propaganda purposes?

.%2037.%20How%20to%20fake%20a%20war-victim%20picture%20for%20propaganda%20purposes%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: US Debt Clock website. October 2023.

............................................................................................................................................

As the image collage above indicates, at the beginning of October 2023 strange things were observed on the US Debt Clock website. New Testament biblical verses started to appear. On Monday 2nd October, Matthew 21:12 (KJV) showed up. And then, on Sunday 8th October, Revelation 1:10 (KJV) appeared. In each case, the texts had a clear end-time significance and were accompanied by an early Christian fish symbol.

It has been suggested that someone with access to very high-level intelligence and an advanced understanding of operations behind the scenes had started to post coded messages. True or False?

More background here (10.10.23), here (03.10.23) and here (09.10.23).

............................................................................................................................................

Picture: Do not be concerned by the uproar going on all around you.

Picture: Meditation for peace. Sunday 8th October 2023.

Picture: Ambassador detained by law enforcement officials at UN, NYC.

Picture: Global Plague PsyOp 2019-2023.

Picture: Free speech in Canada. October 2023.

Picture: White Quartz. Ask the crystal what it can do.

Picture: The Ascension Conference, Chiang Mai, Thailand. 11-12 November 2023.

Picture: Chiang Mai Ascension Conference - Day 1 notes.

...........................................................................................................................

The Ascension Conference in Chiang Mai (Thailand) was a huge success and was accompanied by a lot of underground and extraterrestrial activity.

The second day of the conference brought a very important breakthrough regarding the anchoring of the Goddess energy on the surface of the planet. This is expected to have far-reaching consequences well beyond Asia.

The Chiang Mai Ascension Conference Day 1 notes are here. And the Chiang Mai Ascension Conference Day 2 notes are here.

.......................................................................................................

Picture: Is this how Planet X looks when seen from the Earth?

.%20%5BONE%5D%20%231ab.jpg?SSImageQuality=Full)

...........................................................................................................................

Useful introductory information about Planet X can be found here, here and here (pdf 20pp).

............................................................................................................................................

Picture: Is there an Earth-like planet in the distant Kuiper Belt? Planet X?

.%20If%20so,%20might%20it%20be%20Planet%20X%20(question).%20%231ab.jpg?SSImageQuality=Full)

Picture: L51 now - Sunday 24th September 2023. #1ab

............................................................................................................................................

Friday 15th September 2023

What follows is a lightly-edited summary of the original online text here:

● The Light forces have scored a huge victory recently. The last pit under DARPA has been cleared, and all Chimera individuals from that pit and from the surface of the planet have been removed. Thus the Chimera has been completely defeated and is no more.

● With the removal of the Chimera, cosmic evolution into the Light is not in danger any more, and the positive timeline has been absolutely stabilized. This means that the final victory of the Light and the liberation of this planet is absolutely secured because there are no timelines with negative outcomes remaining.

● With the removal of the last pit and its mainframe computer, the biochips cannot send audio and video signals anywhere any more, and the main control network has collapsed. The biochips are now only dark electromagnetic portals with their power diminishing fast. They will be removed very soon.

● The main control network on the surface of the planet is now a scalar monitoring network through cell phone, 4G and 5G networks, and through wifi networks. These networks are far less reliable as they can only scan human activity with a resolution of between 6 and 15 cm (2 to 6 inches), depending on the network used. This is the main control and surveillance tool the cabal still has in its hands.

● The main factor now delaying the planetary liberation is the Lurker with the subquantum anomaly. The Lurker directly influences human subconsciousness by manifesting subquantum anomaly into quantum fluctuations at the weakest spots of the human energy system. These spots are biochips on the physical plane and implant anomaly remnants on the etheric, astral and mental planes. These quantum fluctuations then facilitate Murphy's law on the physical plane, depression on the astral plane and confusion on the mental plane.

● The black nobility is now on the top of the food chain on this planet. These old Italian family remnants claim their descent from the Roman empire. Their predecessors were mandated by the Chimera 26,000 years ago to run the management and control of the surface human population. Since the Chimera is now gone, they are connecting with the Lurker in their black magic rituals and receiving guidance from him. Black nobility members together with their Jesuit agents number about 2000 people.

● Below these 2000 are about 50,000 Draconians in cloned humanoid bodies who have infiltrated the surface system since 1996 as politicians, businessmen, lawyers and doctors.

● Then there are about 400,000 members of the Illuminati network who are there willingly, and about two million other members who were forced into it. This network is also called the brotherhood of death because someone needs to kill a human being to be initiated into it.

● Then there are about 100 million psychopaths who can be quite dangerous under certain circumstances, such as the doctors and nurses who supported and enabled the 2019-2022 Plague PsyOp.

● Then there are about 400 million sociopaths who lack empathy.

● Then there are about three billion sheeple who do not have the ability for critical thinking and just follow the trends of their societies.

● And finally there are about four billion people who have the ability to think clearly - at least to a degree - and they are the hope for humanity.

● The main factor now delaying the liberation of the planet is the Lurker with the subquantum anomaly. The Light forces are now removing as much of this anomaly as possible in order to safely trigger the Event. They are also releasing intel gradually, because if too much intel is released at once, it triggers a too-strong purification process of the anomaly.

● The dark forces which arrived on Earth 900,000 years ago almost caused the extinction of humanity. Now they are nearing their final defeat.

● A big awakening is coming.

● Planet X is on the verge of being discovered.

AB note: The above bullet-pointed text is an edited summary of the original online text here (15.09.23). That original update has more detail, including black nobility names, and has many supporting links.

............................................................................................................................................

Picture: Depleting the reservoir of the unmanifested subquantum anomaly.

Picture: A plethora of space vehicles descends to evacuate the willing off-planet.

Picture: Chinese intelligence on Qin Gang and Li Shangfu - September 2023.

Picture: BRICS new gold-backed currency 2023?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: True or False? Only an illusory form of democracy is functioning in the West.

.%20The%20legal%20status%20of%20Western%20democratic%20governance.%20%231ab.jpg?SSImageQuality=Full)

Picture: The Event is about to happen.

%20%231ab.jpg?SSImageQuality=Full)

............................................................................................................................................

On Monday 4th September 2023, some new esoteric information came through from the same Pleiadian source that we have cited several times before on this page and others. His codename is Cobra and he is a Pleiadian starseed of the Semjase Soul Family Mandala. The codename Cobra derives from Compression breakthrough. The idea of Compression breakthrough is introduced here.

This individual is the spokesman for the benevolent ET grouping which is active at this time in removing all remaining negative energy ('evil') from the Earth. His most recent Q&A follows here:

Q: How will the First Contact happen for people like me who don't own property?

A: First Contact for people who do not own property will happen at the private land of people who volunteered to give that land for mass Contact.

Q: What can a single person contribute to get rid of the oppressors of this Planet, besides the meditation? I mean, in a more active way.

A: Spread the intel, plant Cintamanis, be kind and loving.

Q: Why is the (planetary) liberation process so slow? Why aren't the Galactic Federation forces taking any physical action against the dark forces? There is one answer, and that is the right of human choice .... Who among us does not want freedom, welfare and love, when the intervention of the forces of light is against our will?

A: The liberation process is so slow because there are so many layers of the dark matrix that have to be dismantled. The will of the surface Lightworkers is clearly in favor of intervention, and intervention will happen as soon as it is safe enough.

Q: Will directed energy weapons be dismantled during The Event? I was targeted by directed energy for 8 years.

A: Yes.

Q: It is said that paying attention to negative and emotionally disturbing news, such as the recent so-called "natural disasters" and the Cabal's other heinous acts, causes a decrease in the frequency of an empath. How can we keep our frequency up while we're getting aware of darkness?

A: Keep yourself informed, but do not spend more than 20 minutes daily for doing so.

Q: Can you give an update on the approximate percentage of clearings? (e.g. How much anomaly, reptilian souls, Chimera, Archons, underground bases/tunnels have been cleaned out?). Things feel a lot lighter lately, much fewer dark attacks.

A: Anomaly is in the process of being cleared, almost all Reptilians are gone from the etheric and astral planes, Chimera is almost completely defeated, Archons / black nobility still keep most of their power, deep underground bases are all cleared, some shallow underground bases and tunnels still exist.

Q: What are the Light Forces (with its various races and organisations) and the Resistance Movement's feelings about the surface human population? To elaborate the question: Do they hate us, do they love us? Are they disappointed in us, are they pitying our situation and care about us? Are they neutral or confused about us and our situation? What is an approximative proportion of how many of them care about us and how many just care to wipe out the darkness? Are they excited or apprehensive to meet us? Are they excited to release all those physical and emotional healing technologies that we can't wait for?

A: They care about the surface population, but they feel pain because they can not intervene directly yet. They are afraid of the power of subquantum anomaly. They do not understand many things about the surface population. They are excited to release healing technologies, they are looking forward to interaction with humans, but are also afraid of it.

Q: After the Evacuation, most of the surface population will live on a Pleiadian planet. Will there already be a structure ready there, of houses, products, technology, a government .... or will we have to start everything from scratch in the middle of the jungle?

A: All infrastructure is already there, human beings there are given assistance, technology, healing and guidance by the Light forces.

Q: Will our pets come with us when we are evacuated?

A: Yes

Q: What will happen after the Event with the many resources accumulated by Humanity, such as literature, poetry, music, art? Much of this has been digitized and is on the Internet. Some (artistic) things are present on the surface of the Earth only physically .... If there is a big tsunami, and much on the planet is washed away by water, what will be preserved? What will happen to Internet resources, such as YouTube Music, for example, and other resources containing the accumulated cultural achievements of Mankind?

A: Most of the best pieces of art have already been rescued from the surface of the planet and are stored at safe locations away from the surface where they will survive the polar shift intact. All online resources of the surface population are copied and stored at safe locations also.

Q: Regarding the rumor of simultaneous meditation around the world, is it true that it is dangerous or ineffective to participate unless you are an expert meditator? I personally feel safe and effective because the meditation procedure includes a protective process, and I will continue to participate, but the above theory is still often claimed.

A: It is safe to participate in mass meditations.

Q: Will the Cabal push a new pandemic/lockdown event during this autumn/winter and stretch it into the next year (elections)?

A: They might try, but they will fail.

Q: Is Delta Option still a possibility the light forces are considering?

A: It is possible, but unlikely.

Q: Have all physical Chimera Spiders been cleared?

A: Yes.

Q: Is it possible for someone to meet their soul mate but not recognize them?

A: Yes and it happens often.

Q: Does invoking the White Fire of AN clear subquantum anomaly?

A: Yes, it helps.

Q: I asked the light forces to very quickly show themselves a while back and I saw two very quick flashes of gold light a minute or two after asking. So because they showed themselves very briefly, does this mean it is somewhat safer for them to briefly show themselves now, even though I understood they can't show properly yet?

A: Exactly.

Q: Were the Hawaiian fires an attack from the Dark Forces?

A: Yes.

Q: Why will cities of light be needed during the tsunami?

A: To stabilize the energy grid to guide the planet through the Ascension process.

Q: Right after the Event will the people know from the free media the importance of the lightworkers' mission?

A: Yes.

Online text source here (04.09.23).

............................................................................................................................................

Picture: BRICS summit in South Africa - August 2023.

Picture: Concerning the US Military - Tuesday 29th August 2023.

Picture: Concerning the lawful governance of The United States of America.

%20%231ab.jpg?SSImageQuality=Full)

Picture: We're already in a post-American and post-Western world.

Picture: Update on the Vatican Trip. US government agencies are being defunded.

Picture: EBOs. Who is trying to hush-up the existence of Exo-Biospheric Organisms?

.%20%231ab.jpg?SSImageQuality=Full)

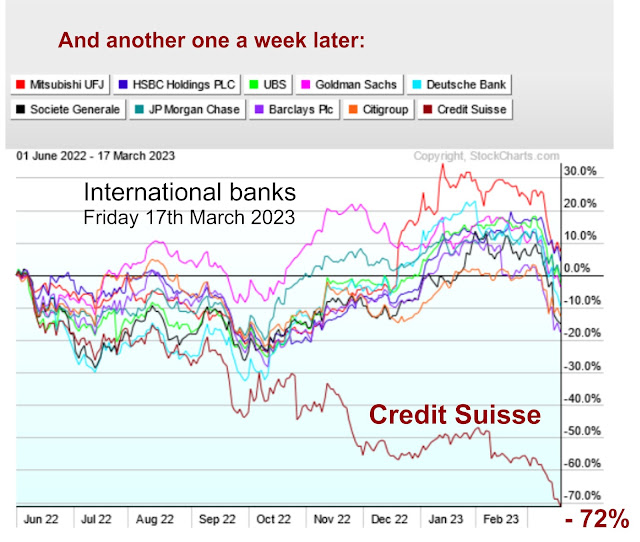

Picture: When the paradigm shifts. The current state of American banking.

Picture: Biden, Zelensky, US, Ukraine and Russia. Saturday 19th August 2023.

Picture: India and UAE complete their first oil sale in Rupees.

Picture: August 2023 - The Lion Frequencies.

.%20Begin%20with%20a%20conscious%20breath.%20%231ab.jpg?SSImageQuality=Full)

Picture: Aldebaran is the brightest star in the Taurus constellation.

Picture: US SSP FedEx cargo craft at work.

Picture: Book - 'Spies - The epic intelligence war between East and West' by Calder Walton.

Picture: Are smart homes becoming digital prisons for future lockdowns?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: Anticipating human lifespans on Earth in excess of 350 years.

Picture: Benevolent ET reptilian R'Kok.

%20Galactic%20Confederation.%20%231ab.jpg?SSImageQuality=Full)

............................................................................................................................................

My Earth friends,

This is R’Kok speaking. I am honored that I am once again able to share a message with the people of Earth.

As has often been stated, we galactics are not the saviours of mankind. We’re the support. You lightworkers are the saviours. You are the ones you have been waiting for.

The plain truth is what everyone already knows: this covert and very slow path that the gray hats are taking is not in fact optimal. It would have been better if mass arrests had happened years ago. So much suffering and so many deaths would have been prevented.

Alright, so we galactics agree with you that the gray hats should be doing more. But it’s always easy to say that other people should do more. Why aren’t we galactics taking more action ourselves?

Well, we galactics are supporting you energetically. We are helping to raise the energy on your world. We’re doing a lot of subtle work, such as purifying your water and air. We have dealt with most malevolent galactics already and are cleaning up the relatively few who remain.

We are preventing certain disasters from occurring and we are doing important special operations behind the scenes. Some galactics have died during these missions.

Now, obviously you are suffering more than we are, I am just saying that to illustrate that we are serious about helping you. Millions of galactics are away from home right now in order to help you. We are willing to take casualties to help you. A not insignificant number of galactics are volunteering to do dangerous missions to help our Earth brothers and sisters, even though those same galactics could also just choose not to volunteer and to have a centuries or millennia long life in what you would think of as something close to paradise.

Also, we galactics too are eagerly looking forward to meeting you, physically, in the flesh. However, at this specific moment in time we don’t think it’s a good idea for us to do more than what we’re currently doing, although that may change in the future.

One issue is that if we land openly and we say that we come in peace, then the dark controllers would order your militaries to start shooting us. Plenty of soldiers would follow orders. And if we defend ourselves, or if we do a mass arrest of dark controllers, or if we remain in orbit and take over your media from up here, then dark controllers would spin that as Earth getting invaded by hostile aliens. From a consciousness standpoint it wouldn’t benefit you to seemingly get invaded by hostile aliens. Us seemingly invading you would also delay the point when we can openly walk among you in peace.

Then there’s an issue that us landing in peace wouldn’t at this point violate your free will, but us taking over your mainstream media or doing mass arrests on your world would violate your free will. If you polled Earth humans today, most of them wouldn’t vote for aliens doing these things.

Then there’s the issue that if we just hand you an advanced civilization, it may very well not last, and in a couple of centuries we might be right back to the current situation. We handed you an advanced civilization in Atlantis, and it didn’t last, and we learned from Atlantis that it simply doesn’t work for a more advanced race to just push a less advanced race into a so-called more advanced way of living. This may seem heartless, but we genuinely do think that it’s preferable to Earth humans to be in a tough or even awful situation until 2024 or 2025 or 2026, rather than risk another Atlantis-style collapse and the darkness that would follow.

And yes, at this specific moment in time we can’t just land peacefully and openly, because we’d get shot at. We don’t have an endless capacity to just sit there and absorb fire.

To peacefully land, we need one of two things. Either we need the consciousness of Earth to be higher, so that soldiers won’t shoot at us even when ordered. Or we need Earth’s military and police and intelligence forces to finally do mass arrests, so that there are no dark controllers who would order soldiers to shoot at us. When the consciousness of Earth is high enough, your military and police and intelligence forces will do mass arrests.

In a way, you already know this: the dark controllers wouldn’t be acting so crazily and in such an obviously corrupt way if they were genuinely in control. If they were genuinely in control, they’d act in a much slower and more subtle way, so that the illusion would be maintained that the media and the government are working in the interest of the people.

By now many people in the west realize that the media and the mainstream political parties are actively working against the people. This is actually a huge deal. Fifty years ago the dark controllers weren’t panicking, and they were maintaining their illusion of fairness much better, and the vast majority of people thought that the media spoke the truth and that politicians served the people. Today many people no longer believe that. This is a huge change in consciousness and perception in a relatively short period of time.

I understand that you would prefer your freedom today, and you do deserve your freedom, however the consciousness of humanity is already being transformed at a breakneck and dizzying pace. Certain other galactic races have taken a century or even a millenium to achieve the consciousness transformation that humanity is going through in one year. Uplifting the entire consciousness of humanity is a process that simply takes some time. As (the Pleiadian) Hakann has stated before: I expect that your living conditions will likely be much improved before the end of 2026, perhaps even well before then. Galactic contact may occur before that time too.

Your star brother,

R’Kok

The full text of R’Kok's message can be found here (13.07.23).

AB note: The text presented above is a small excerpt from a much longer piece by R’Kok. The emphases in bold are ours.

Since the positive spiritual and energetic shake-up in 2012, and the subsequent multiplication of veridical communication channels from the Higher Evolution to the surface population of humans on Earth, many completely new transdimensional teachers have emerged. Some of these offer their content in English.

One such individual worthy of consideration is R’Kok. He is an advanced ET reptilian who, as he says himself, has murdered millions of people in the past. He has since repented, moved from the darkness to the light, and is is now working as a military advisor for the benevolent Galactic Confederation of star nations.

Since 2012, this confederation's starship fleet, the largest ever assembled in the history of our universe, has been deployed in and around the Earth, the Moon and the Solar System.

In the last eighteen months or so, that fleet has constructed/positioned two huge Dyson spheres, one around the Sun and one around the Earth, in anticipation of the end-time solar flash/ascension events.

And with regards to reptilians, it is said that many humans now living on Earth have themselves, in past incarnations, lived lives as reptilians on planets in other star systems.

Elsewhere in this blog we have compiled more background information about the ETs living among us here, and about the (possibly imminent) solar flash/ascension events here.

............................................................................................................................................

Picture: Archangel Metatron, Archangel Michael, Commander Ashtar, Mother Mary.

............................................................................................................................................

● It is not important to anyone's spiritual growth to know the future.

● No matter how it plays out, you will all be taken care of.

● When the solar flash/ascension that you have heard about arrives, you will be gently guided on a new path. Your soul and higher self have absolute choice over what you want to do. This is not something that is done to you; it is something that you freely choose to do yourself.

● Gaia (Mother Earth) is an archangel; a very evolved being full of love. She stepped into this role of becoming a planet and taking it from darkness to light.

● Many of you on the planet now have been here since right after Gaia's creation, billions of years ago.

● The human collective consciousness of Gaia is controlling what is happening. We do not interfere. Mother and Father do not interfere either.

● In your group meditations, state your intent, visualise what you want and so it is! Focus on what you want, step into your power and stay in your power.

● A nuclear war is not going to happen; it is not allowed to happen.

● You are not at the whim of some god-like being or out-of-control aliens.

● Things happen quickly. Remember: a switch can be flipped very quickly.

Source and esoteric background here.

............................................................................................................................................

Picture: Nazi continuum Fat Controllers active in UK politics? Friday 21st July 2023.

.%20Friday%2021st%20July%202023.%20%231ab.jpg?SSImageQuality=Full)

Picture: UK banker: Freedom of expression and access to banking are fundamental to society.

Picture: Ukraine, NATO and Zelensky. Monday 17th July 2023.

Picture: How dangerous are mRNA vaccines?

Picture: Lancet paper on post-vax autopsies.

............................................................................................................................................

A pre-print review of autopsy data of more than 300 post-Covid-19 vaccination deaths was removed by the Lancet within 24 hours of its initial submission, according to cardiologist Dr Peter McCullough, the paper’s leading author and prominent COVID vaccine skeptic.

"The government narrative is still that people do not die after COVID-19 vaccination. Now we have the largest series of autopsies, and the autopsies really are incontrovertible," he told the Epoch Times.

"The paper was uploaded to the Lancet's pre-print website on July 6, only to be taken down with a note implying that the study violated the medical journal's "screening criteria."

"Pre-print servers go through a check to make sure all the elements of the paper are there, but it is not peer-reviewed by external doctors. And the preprint server simply offers people a chance to look at the data themselves and decide," McCullough told the Times' Jan Jekielek. "I think that’s perfectly fair to look at the tables, look at the figures."

"Obviously, we struck a very important gap in knowledge and the world needed to know the results."

The paper was co-authored by Yale epidemiologist Dr Harvey Risch and their colleagues at the Wellness Company, a Florida-based medical group.

The study looked at 678 published papers, 44 of which contained the 325 autopsy cases. They then used a "blind adjudication" process by which three physicians independently review all the deaths and determine whether the Covid-19 vaccine caused, or contributed significantly, to the deaths.

"We use the standard called PRISMA, where we searched for every paper possible. We sorted through hundreds and hundreds of manuscripts because deaths can be reported as different clinical syndromes are coming out after the vaccine," said McCullough.

"There were deaths where there was an auto accident or a suicide. There were some cases in nursing homes where people are on hospice and it looked like they were in their last days of life. We just couldn’t attribute it to the vaccine," he added. "But the striking cases were people who were perfectly healthy, who had no other medical problems. The only new thing in their life was a vaccine, and then they died with an obvious syndrome like a blood clot, or heart damage, or myocarditis."

The full article can be found at ZeroHedge here (12.07.23).

AB note: The Lancet claims to be an independent, international general medical journal. It was founded in England (UK) in 1823 by Thomas Wakley. The journal is owned and controlled by Elsevier. Elsevier is a Dutch academic publishing company dating from 1880. In 2021, Dr Peter McCullough (pictured above) sued Elsevier for censorship. Background details here (03.01.22).

............................................................................................................................................

Picture: Agriglyph (crop circle) nr Owslebury, Hampshire, England (UK). June 2023.

%20at%20Allan%20King%20Way,%20nr%20Owslebury,%20Hampshire,%20England%20(UK).%20Monday%2026th%20June%202023.%20(ONE)%20%231ab.jpg?SSImageQuality=Full)

............................................................................................................................................

The agriglyph pictured above was reported on Monday 26th June 2023 near Owslebury, Hampshire, England (UK). It is mathematically complex in construction and may have a flaw at the right-hand side of the fifth triangle at the top right (see rotated clickthrough). Agriglyphs are often called crop circles even though some of them have no major circular component(s) in their designs.

The map reference of this one was: SU5295624573. And some initial ideas, published responses and interpretations can be found here.

............................................................................................................................................

PIcture: The Ascension Conference (Kyoto, Japan). 8th-9th July 2023.

.%208th-9th%20July%202023.%20%231ab.jpg?SSImageQuality=Full)

Picture: Planetary Situation Update and Kyoto Ascension Conference Report - July 2023.

Picture: Activity around Saturn and on Earth's Moon.

Picture: Activity in the sub-lunar space.

Picture: The benevolent ET Central Civilization.

Picture: France ignites. June-July 2023.

Picture: Emmanuel Macron contemplates the end-time ruination of France.

Picture: A Notre-Dame gargoyle looks out over Paris.

.%20%231ab.jpg?SSImageQuality=Full)

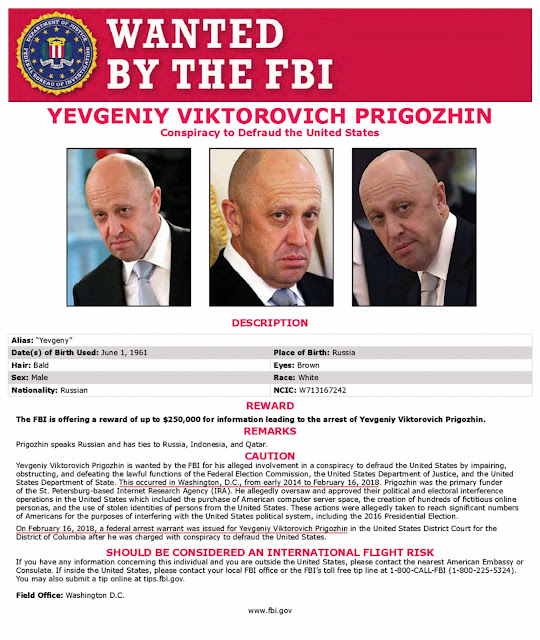

The USA and Yevgeniy Viktorovich Prigozhin of Russia and Belarus. #1ab

............................................................................................................................................

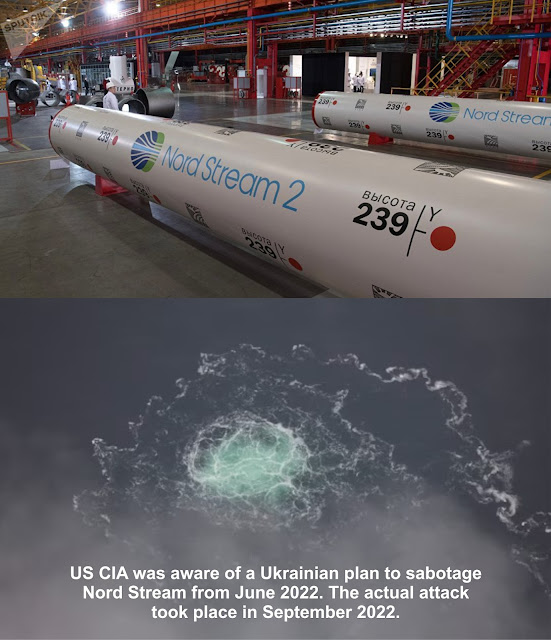

By the early morning of Sunday 25th June 2023, European time, it had become clear that the Prigozhin tantrum in Southern Russia had fizzled out, the roads were open again, and the Western mainstream media's attempt at another Russophobic psyop had failed spectacularly in less than 48 hours.

AltNews background coverage here (24.06.23), here (24.06.23), here (24.06.23), here (24.06.23), here (24.06.23) and here (25.06.23).

A suggestion that US Rogue Faction AI may have been involved in setting up the Russophobic Wagner-Prigozhin psyop is introduced here (26.06.23) and here (26.06.23).

And Thierry Meyssan (France) reports that contrary to comments in the Western press, Yevgeny Prigozhin never attempted a coup against Vladimir Putin. He simply wanted to blackmail him in order to preserve the exorbitant privileges he had accumulated since the creation of his private military company, Wagner. Subsequently, he came to his senses and returned to post without a fight. More here (27.06.23).

............................................................................................................................................

Picture: Mary Wollstonecraft's radical move in the 1790s.

.%20%231ab.jpg?SSImageQuality=Full)

Picture: ET Pleiadian craft flies over the Neumayer Area of Antarctica in Jan 2016.

Picture: Changing perceptions and the waking of a nation?

.%20%231ab.jpg?SSImageQuality=Full)

Picture: I never contradict the staus quo.

Picture: Depleting the reservoir of the unmanifested subquantum anomaly.

............................................................................................................................................

More (estoteric) background here and here. Plus a topic-associated cartoon video here.

............................................................................................................................................

Picture: Concerning the lawful governance of The United States of America.

%20%231ab.jpg?SSImageQuality=Full)

Picture: Ukraine, NATO and Russia. Saturday 10th June 2023.

............................................................................................................................................

Contrary to most up-page reports in the Western mass media, in six days, the Western weapons amassed by the Ukrainian army were virtually all destroyed (ammunition, tanks and aircraft). The human toll exacted by Ukraine’s catastrophic counter-offensive was beyond counting.